We are here to forecast DLF share price for the years 2023, 2024, 2025, 2026 to 2030. The target price for DLF shares is based on market trends, financial results, performance, history, business model and others.

The company has shown excellent financial results over the years and has given huge returns to its investors. In 2020, the share price of DLF was just Rs 125.25 and it has grown to Rs 460.85 in three years, a gain of 268 per cent.

For example: If you had invested Rs 1 lakh now, it would have grown to Rs 2.68 lakh in less than three years.

The company has released its financial results for FY 2023. The company reported that the revenue is Rs 5695 crore and the net profit is Rs 2036 crore and the net profit margin is 35.76 per cent.

DLF Limited- Fundamentals 2023

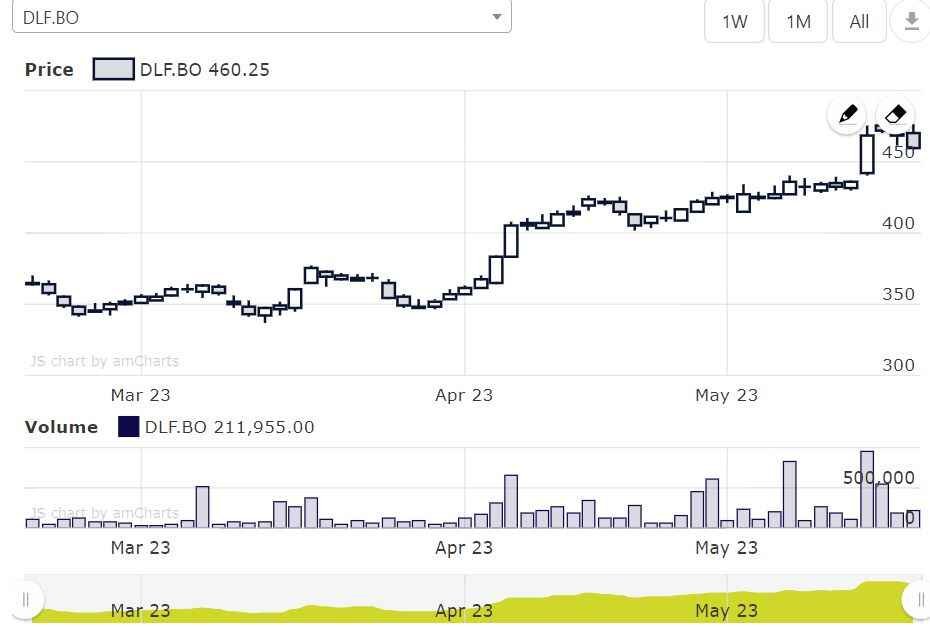

The company is listed on both NSE and BSE in India. Currently, the share price is Rs 460.85 and the traded volume is 6,005,061. More details are given below:

| Company Name | DLF Limited |

| Industry Type | Construction |

| Country | India |

| Traded Volume | 6,005,061 |

| Primary Exchange | NSE/BSE |

| Market Cap | ₹ 1,16,773 Cr |

| Revenue | ₹ 5,695 Cr |

| Net Profit | ₹ 2,036 Cr |

| Net Profit Margin | 35.76% |

| EPS (TTM) | 8.24 |

| Dividend Yield | 0.65% |

| Dividend per share | 4.00 |

| P/E Ratio (TTM) | 57.33 |

| ROE | 5.51% |

| 52 Week Low | 294.70 |

| 52 Week High | 478.70 |

| Debt To Equity | 0.09 |

| Buy/Sell/Hold | Hold |

| Face Value | 2 |

| Official Website | https://www.dlf.in |

DLF Limited- Overview

Delhi Land and Finance (DLF) Limited was established in 1946 and become a trusted real estate developer in India. Over the years, DLF has established itself as a leader in the residential, commercial and retail segments of the real estate industry. So, it has multiple projects in several sectors and is known for quality construction and sustainable practices.

The company has developed several high-profile projects such as residential complexes, IT parks, shopping malls, hotels, etc. As experts, we need to analyze company fundamentals, market conditions and future prospects before predicting share price targets.

DLF Popular Projects

DLF is engaged in a number of projects in the real estate sector, which are in Gurugram and Delhi, such as DLF Cybercity, an advanced IT and commercial hub, and DLF Emporio, a luxury retail destination, DLF New Town Heights, etc.

DLF has consistently focused on delivering value to its customers, investors and stakeholders. The company’s emphasis on customer satisfaction and ethical business practices in the industry. It is a popular choice for investors for its excellent financial results and strong brand presence in the real estate industry.

DLF Subsidiary & Joint Venture List

DLF Limited has several subsidiaries and joint ventures to expand its operations. Here is a list of subsidiaries and joint ventures associated with DLF:

- DLF Home Developers Limited (DHDL): It is an owned subsidiary and focuses on the development of residential projects at various locations in India.

- DLF Cyber City Developers Limited (DCCDL): It is a joint venture between DLF Limited and Singapore’s sovereign wealth fund GIC, which is known as DLF Cybercity in Gurugram.

- DLF Retail Developers Limited (DRDL): DRDL is a wholly owned subsidiary of DLF Limited. It is responsible for the development and management of retail properties including shopping malls and retail complexes.

- DLF Downtown Joint Venture: DLF has a joint venture with Singapore’s sovereign wealth fund GIC. The project aims to create a vibrant urban centre with residential, commercial and retail components.

These are some of the subsidiaries and joint ventures that DLF Limited has entered into to expand its presence in the industry and enhance its portfolio.

DLF share price target for 2023, 2024, 2025 to 2030

Share prices are always subject to risk and may differ from the actual price. The target prices are only estimated values that are based on our experience, research and technical analysis.

Market experts say that in 2025, DLF share price will have an upward trend and the maximum price can be Rs 525.50 per share. In this article, we will predict the share price of DLF for the years 2023, 2024, 2025 to 2030.

Check live share price:

Note: The target price is based on our experience, research and technical analysis. As the share price is always subject to market risks due to various reasons and may differ from the actual price. Therefore, do your own research and consult your financial advisor.

| Year | Target-I (₹) | Target-II (₹) |

|---|---|---|

| 2023 | 464.14 | 486.21 |

| 2024 | 492.23 | 518.42 |

| 2025 | 512.52 | 544.33 |

| 2026 | 538.22 | 558.21 |

| 2027 | 553.46 | 574.62 |

| 2028 | 568.84 | 593.23 |

| 2029 | 588.12 | 618.32 |

| 2030 | 620.28 | 647.54 |

2023

In 2023, the share price may see an upside move and the year-end maximum share price target for DLF is Rs 464.14 to Rs 486.21.

2024

For 2024, the minimum target price for DLF shares would be between Rs 478.20 and Rs 492.32. In the middle of the year, with further upside and an upper price target of Rs 492.23 to Rs 518.42 for DLF shares.

2025

In 2025, As per our research and technical analysis, a minimum share price target for DLF could be Rs 495.42 to Rs 512.52. There may be an upside to the share price and an upper target price of Rs 512.52 to Rs 544.33 for DLF shares at the end of the year.

2026

In 2026, the minimum price target for DLF shares is Rs 518.21 to Rs 538.22. An upside trend can be seen in the middle of the year, and a maximum price target of Rs 542.32 to Rs 558.21 is expected for DLF shares.

2028

From a long-term perspective, DLF shares will remain profitable with a minimum price target of Rs 552.23 to Rs 568.84. At the end of the year, the maximum target price for DLF shares can be expected in the range of Rs 578.31 to Rs 593.23 by 2028.

2030

Looking even further into the future, DLF’s share price target for 2030 is expected to be in the range of Rs 605.12 to Rs 620.28. However, there is a bullish trend in the middle of the year. And the maximum target price for DLF shares by 2030 is expected to be Rs 630.20 to Rs 647.54.

Risk Factors

There are several risk factors that may affect the DLF share price in the coming years, which are mentioned below:

- Real estate market trends: The share price of DLF depends on urbanisation, population growth and economic stability. If any problem is found then the share price can be affected.

- Company performance: DLF’s financial results, revenue growth, profitability, and debt levels will directly impact its share price. So, Investors should closely watch the company’s annual report, quarterly earnings and management’s guidance.

- Government Policies: Changes in laws related to the real estate industry, such as land acquisition policies, environmental regulations and others, may affect the share price.

- Competitive marketplace: It is very competitive, and the presence of other major developers can affect DLF’s share price.

FAQs

Ans: The highest target price for DLF shares is Rs 512.52 to Rs 544.33 by 2025.

Ans: The current market price of DLF shares is Rs 460.25 on May 2023.

Ans: The maximum target price for DLF shares could be Rs 578.31 to Rs 593.23 by 2028.

Ans: The market capitalization of DLF in 2023 is Rs 1,16,773 crore.

Conclusion

Accurately estimating a share price is a complex task as it can be affected by a number of factors. Bankshala team provides estimated share price targets for DLF for the years 2023, 2024, 2025, 2026, 2028 and 2030. Investors should research well before making an investment decision. But, considering the company’s fundamentals, market position, profitability and other factors, DLF can be a good option for the long term.

Related:

Disclaimer: DLF’s stock target price is based on our experience, research and technical analysis. As the share price is always subject to market risks due to various reasons and may differ from the actual price. And no part of the website material provided by us should be considered financial advice. Before investing in any company, you should do your own research and consult your financial advisor.