We are here for the Infosys Limited share price forecast for the year 2023 to 2030. Share price predictions are based on our research, company fundamentals, history, our experience and several technical analysis. Before we make a share price forecast, we need to mention some basic information about the company.

Infosys is an information technology company IT) based in Bangalore, India. It was established in 1981 and is one of the largest IT companies in the world. The company provides its services in the following areas, App Development, Cloud Services, Data Analytics, Cyber Security etc.

Most of the clients are from the banking, finance, healthcare, retail and pharma sectors. It has a strong reputation in the IT industry and has received several awards for its contributions. The company is listed on these exchanges, NYSE, NSE and BSE.

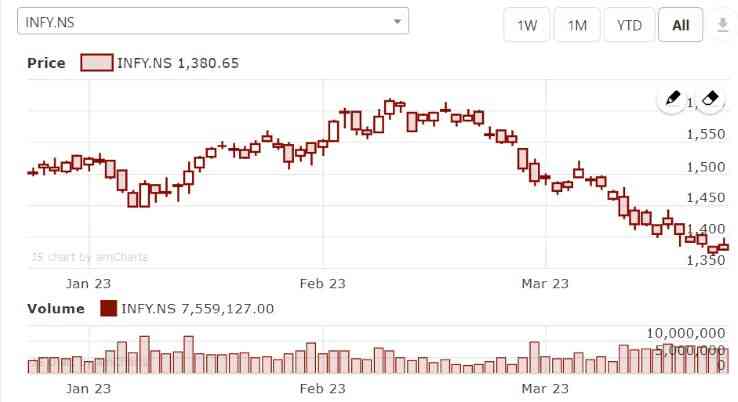

As per the official data, the total revenue in FY22 is Rs 1,21,641 crore and the net income is Rs 6,586 crore. It has a market capitalization of Rs 572,770 crore and a trading volume of 7,559,127.

Currently, its share price is Rs 1380.65, which is a decline of 13.75% ↓ in one month. Overall, the company has consistently performed very well and given double the returns over the long term. It has strong financial growth prospects and is a good stock for the long term.

Fundamentals of Infosys Ltd

| Company Name | Infosys Limited |

| Industry | IT Industry |

| Country | India |

| Primary Exchange | NSE/BSE/BSE |

| Founded | 1981 |

| Traded Volume | 7,559,127 |

| Market Cap | ₹ 572,770 Cr |

| Revenue | ₹ 1,21,641 Cr |

| Net Profit | ₹ 6586 Cr |

| Net Profit Margin | 17.21% |

| EPS (TTM) | 56.29 |

| PE (TTM) | 24.40 |

| Dividend Yield | 2.27% |

| ROE | 29.14% |

| Debt to Equity | 0.10 |

| 52 Week Low | 1355.00 |

| 52 Week High | 1919.00 |

| Buy / Sell / Hold | Buy (March 23) |

| Face Value | 5 |

| Official Website | www.infosys.com |

Infosys share price history – Last 5 years

The company has strong financial results in the last 5 years and has provided a maximum of 261.81% share price growth in the last 4 years.

| Year | Low | High |

|---|---|---|

| 2018 | 551.00 | 754.00 |

| 2019 | 651.00 | 847.00 |

| 2020 | 582.15 | 1258.00 |

| 2021 | 1231.00 | 1909.80 |

| 2022 | 1355.00 | 1953.00 |

| 2023 | 1492.40 | — |

Shareholding Pattern

| Promoters | 15.13% |

| Foreign Institutions | 36.23% |

| Domestic Institutions | 12.68% |

| Mutual Funds | 17.65% |

| Retail & Others | 18.21% |

Infosys share price targets for 2023 2024 2025 to 20230

Note: A share price target is a prediction of what a certain company’s share price is expected to be in the future. It is decided by fundamental analysis and technical analysis, followed by arriving at the target price. Therefore, the share price target is the expected price and the actual price may differ. Therefore, do your own research and consult your financial advisor.

Infosys Ltd’s share price has shown tremendous performance over the past few years and is up 261.81% in 4 years. Bankshala team has set different share price targets for this company.

But, there are some market analysts who believe that the company’s share price could reach Rs 1,830 in 2025, while others have set a more ambitious target of Rs 3,850 in the longer term by 2030.

2023

Based on our research, experience and technical analysis, the lowest share price target will be Rs 1310.20 to Rs 1450.20 in 2023. And at the end of the year, the maximum target price for the Infosys share will be Rs 1550.50 to Rs 1660.30.

2024

In 2024, as per our experience, research, history and forecast system, the lowest share price target will be Rs 1550.20 to Rs 1780.40. And at the mid of the year, the maximum target price for the Infosys share will be Rs 1805.20 to Rs 2060.30.

2025

Based on our research, experience and technical analysis, the lowest share price target will be Rs 1930.40 to Rs 2125.40 in 2025. And at the end of the year, the maximum target price for the Infosys share will be Rs 2275.40 to Rs 2450.20.

2026

In 2025, as per our experience, research, history and forecast system, the lowest share price target will be Rs 2250.20 to Rs 2340.30. And at the mid of the year, the maximum target price for the Infosys share will be Rs 2350.70 to Rs 2560.20.

2028

In 2025, as per our experience, research, history and forecast system, the lowest share price target will be Rs 2720.40 to Rs 2880.70. And at the end of the year, the maximum target price for the Infosys share will be Rs 3020.20 to Rs 3240.50.

2030

Based on our research, experience and technical analysis, the lowest share price target will be Rs 3350.10 to Rs 3540.20 in 2030. And at the mid of the year, the maximum target price for the Infosys share will be Rs 3850.60 to Rs 4050.30.

Risk factors

Several factors may affect Infosy’s share price in future, which are given below:

- Industry Trends: Downward trends in Infosys’ clients’ industries may also affect Infosys’ share price target.

- Government Policies: Changes in government policies and going against them can affect the share price.

- Financial Performance: Financial performance such as revenue growth, profit margin and earnings per share can have a significant impact on its share price.

- Competitive market: If there are new entrants or existing competitors who are doing well, it may put pressure on Infosys to outperform and affect Infosys’ share price.

Should we invest in Infosys stock?

It has strong financial results and a customer base over years. So, for those who are looking for long-term, Infosys would be a good option. However, there is always risk involved in the stock market. Hence, do your research and consider your risk tolerance before investing.

FAQs

A: The current share price of REC Limited is Rs 1378.95 in 2023.

A: Infosys share has a maximum price target of Rs 2275.40 to Rs 2450.20 in 2025

A: Yes, it is good for the long term and you can expect double returns in 3-4 years.

A: Infosys Ltd share price target will be Rs 3850.60 to Rs 4050.30 by 2030.

Conclusion

Infosys Ltd’s share price target is an estimated future price that can help investors in making buying or selling decisions. While it depends on future performance, there are many factors that can affect it. As always, investors should do their research and seek professional advice before making any investment decision.

Disclaimer: The share price forecasts on our website (bankshala.com) are for general information only. We are not SEBI-registered financial advisors and no part of the website content provided by us should be considered financial advice. Before investing in any company you should do your own research and analyze and consult your financial advisor before taking any decision.