We are here with Jindal Steel to predict its share price for the years 2023 to 2030. The company has given bumper returns of up to 72.28% to its investors in the last 9 months.

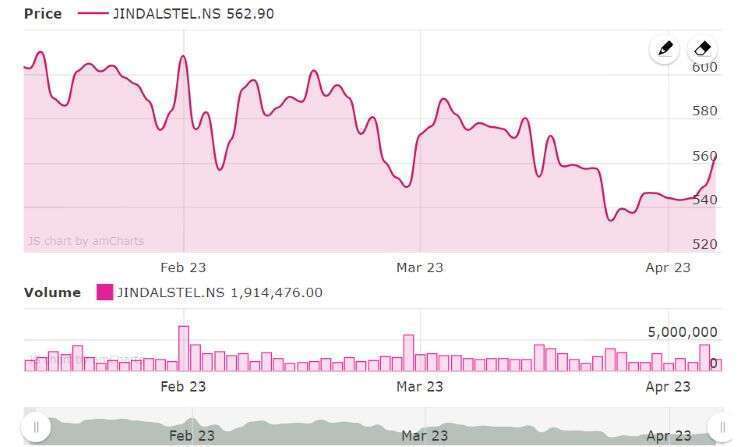

If we look back, the share price was Rs 332 per share in June 2022 and it is currently trading at Rs 563, up 72.28%. But the highest share price was Rs 623 in Feb 2023 showing a fall of 7.82% in Apr 2023.

We can say a multi-bagger stock which has given investors a return of seven times i.e. around 735.61% in just three years. It has strong management and has shown strong financial results over the years.

So, if you are looking for long-term stock then this can be a good option. Market analysts have given a “Buy Rating” and the brokerage firm expects the stock price can go up to the Rs 805 level by 2025.

Before predicting its share price target, we need to mention the business model of this company:

About Jindal Steel & Power Limited

Jindal Steel & Power Limited (JSPL) is an Indian leading company with a dominant presence in the steel, power, mining and infrastructure sectors. It was founded in 1979 by Om Prakash Jindal, father of Naveen Jindal.

Apart from India, JSPL has a presence in several other countries including Australia, Mozambique, South Africa, etc.

The main focus is on steel production (capacity of 9.6 million tonnes per annum) and power (1634 MW CPP), but the company also operates coal mines and has recently entered the renewable energy sector with a focus on wind and solar power.

Fundamentals of JSPL

The company is publicly-traded and listed on both NSE in India. It has a market capitalization of over Rs 55,226 crore as of April 2023 and has reported a revenue of Rs 12,452 crore in Q4 FY22.

| Factory Name | Jindal Steel & Power Limited (JSPL) |

| Industry | Steel, Power & Mining sectors |

| Country | India |

| Founded | 1979 |

| Primary Exchange | NSE |

| Traded Volume | 55,226 |

| Revenue | ₹ 12,452 Cr |

| Net Profit | ₹ 518.67 Cr |

| Net Profit Margin | 4.17% |

| EPS (TTM) | 52.92 |

| P/E Ratio | 19.21 |

| Dividend Yield | 0.39% |

| ROE | 24.47% |

| D/E Ratio | 0.39 |

| Buy/Sell/Hold | Buy |

| 52 Week Low | 304.20 |

| 52 Week High | 622.75 |

| Face Value | 1 |

| Official Website | https://www.jindalsteelpower.com |

Check the table below for the latest updates:

JSPL Share price history

If we look at the historical share price performance, the company’s share price in March 2020 was around Rs 90.70 to Rs 140.50. And it increases up to Rs 622 at the beginning of the year by 2023, a remarkable growth of 320% during this year.

| Year | Low (₹) | High (₹) |

|---|---|---|

| 2018 | 154.05 | 252.10 |

| 2019 | 96.60 | 178.10 |

| 2020 | 82.20 | 266.45 |

| 2021 | 261.75 | 441.50 |

| 2022 | 329.25 | 583.55 |

Jindal Steel share price target 2023, 2024, 2025, 2026, 2028, and 2030

In this article, we will take a look at Jindal Steel’s share price targets for the years 2023 to 2030 based on various factors such as financial performance, industry trends and past performance. While past performance is not indicative of future results.

We will also find out with our experience, research and a lot of technical analysis. So that Jindal Steel’s share price remains accurate at the expected target range of share price in coming years.

2023

In 2023, as per our research and technical analysis, the first target price for Jindal Steels shares could be around Rs 565.20 per share. There will be further upside and finally, the maximum share price target for Jindal Steel shares can be Rs 605.35.

- Minimum share price target: Rs 565.20

- Highest share price target: Rs 605.35

- Average share price target: Rs 585.40

2024

As per our research and technical analysis, the minimum share price target for Jindal Steel shares can be around Rs 625.15 per share. At the end of the year, it will go up and finally, the maximum target for Jindal Steel stock will be Rs 685.70.

- Minimum share price target: Rs 625.15

- Highest share price target: Rs 685.70

- Average share price target: Rs 645.25

2025

In 2025, as per our research, experience and forecasting system, the first possible target for Jindal Steel shares could be around Rs 710.45 per share. And in the middle of the year, it will show an uptrend and the maximum share price target for Jindal Steel shares will be Rs 805.25.

- Minimum share price target: Rs 710.45

- Highest share price target: Rs 805.25

- Average share price target: Rs 775.15

2026

As per our research and technical analysis, the minimum share price target can be around Rs 820.25 per share. It will go up and at the end of the year, the maximum target for Jindal Steel shares will be Rs 875.75.

- Minimum share price target: Rs 820.25

- Highest share price target: Rs 875.75

- Average share price target: Rs 845.65

2028

In 2028, the minimum share price target is Rs 1040.30. It will again go up further and finally, the maximum target for Jindal Steel’s share price will be Rs 1155.25 per share.

- Minimum share price target: Rs 1040.30

- Highest share price target: Rs 1155.25

- Average share price target: Rs 1095.55

2030

As per our research and technical analysis, the minimum share price target for Jindal Steel shares may be around Rs 1040.30. At the same time, the maximum target for Jindal Steel shares in the middle of the year can be Rs 1425.65 per share.

- Minimum share price target: Rs 1250.15

- Highest share price target: Rs 1425.65

- Average share price target: Rs 1350.20

Note: Of course, these are only estimates, and the actual share price may differ depending on a variety of factors. It is important to do your research and consult a financial advisor before making any investment decision.

Jindal Steel share price targets for 2025 and 2030

Jindal Steel has several ongoing projects and expansions, which are likely to increase its revenue and profits. For example, the company is currently working on a 6 MTPA integrated steel plant in Odisha, which is expected to be commissioned by the end of 2023.

Based on these factors, it is reasonable to expect that Jindal Steel’s share price may continue to rise in the years to come. Furthermore, based on our analysis and its growth potential in the steel and power industry, we believe Jindal Steel’s share price can reach a target of Rs 805 to 850 by 2025, and Rs 1250 to Rs 1425 by 2030.

Risk factors

There is always risk involved in the stock market, and you should always consider this before investing:

- Management decision: A wrong decision can go against the company, which can have an impact on revenue and profits.

- Competition: All the companies face these problems as all the companies in this sector can compete with each other which can affect the revenue and profits.

- Government Financial Laws: If the laws go against the company then it can affect its growth in future.

- Global crisis: This is rare, however, can happen and can affect a company’s financial structure.

FAQs

A: The share price of a publicly traded company like Jindal Steel is important to investors as it reflects the market’s perception of the company’s financial position and future prospects.

A: The maximum share price target for Jindal Steel shares would be Rs 805.25 per share by 2025.

A: Jindal Steel has several ongoing projects and expansions, such as the construction of a 6 MTPA integrated steel plant in Odisha, which is expected to be commissioned by the end of 2023.

A: The maximum share price target for Jindal Steel shares would be Rs 1425.65 per share by 2025.

A: Based on various factors and analysis, it is expected that Jindal Steel’s share price may reach the target range of Rs. 710 to Rs 805 by 2025 and Rs 1250 to Rs 1400 by 2030. However, predicting future stock prices is always uncertain.

Disclaimer: The share price targets on our website (bankshala.com) are for general information only. We are not SEBI-registered financial advisors and no part of the website content provided by us should be considered financial advice. You should do your own research and take advice from a financial expert before investing in any company.