SBI Positive Pay System is a secure process for the customer while making payments through a chequebook. The State Bank customers can use the Positive Pay system in 2 ways for high-value cheques.

As per RBI directives, the State Bank of India has facilitated a ‘Positive Pay System’ for the issuer of the cheques to prevent tampering with the cheque payments.

If you use this facility, the bank officials will cross-check before clearing the cheque payment. Hence, it is beneficial for you, and it helps in preventing any kind of fraud incidents. Generally, it is used when you pay a large amount of cheque.

So, if you want to use this system for large amounts of cheques, then this guide will help you. To submit it online, you must enter cheque payee details like name, date, account number, etc. You can do this through mobile banking or by using internet banking.

What is SBI Positive Pay?

As per RBI instructions, SBI Bank introduced a PPS (Positive Pay System) for all cheque payments from 1st January 2021. When you use this system, the bank will re-verify the cheque details, which will be cross-checked with the cheque presented at the time of encashment.

It is a measure for preventing fraud through tampering/change in check details. SBI and the other bank also are planning to make the ‘Positive Payment System’ mandatory for cheques of ‘Savings Bank Accounts‘ of Rs 5 lakh and above.

Also, for other accounts, such as ‘Current Account/Cash Credit/Overdraft‘, Rs 10 lakh and above.

You can join to avail of this facility, and it is a one-time registration process. for the registration and submission, you can do it through Internet Banking, Mobile Banking (Yono Lite) and Yono SBI App.

How To Use of SBI Positive Pay System?

There are three main ways you can deposit your high-value cheque online using the Positive Pay System. You can submit through Mobile Banking as well as SBI Internet Banking. But, another offline method is also available; you must visit the branch.

- Yono Lite

- Yono SBI

- Internet Banking

- Branch Visit

Through Yono Lite

You must have the Yono Lite app on your mobile for this facility. Apart from Yono Lite, you can also do it through YONO SBI. Following are the steps to submit through the Yono Lite app.

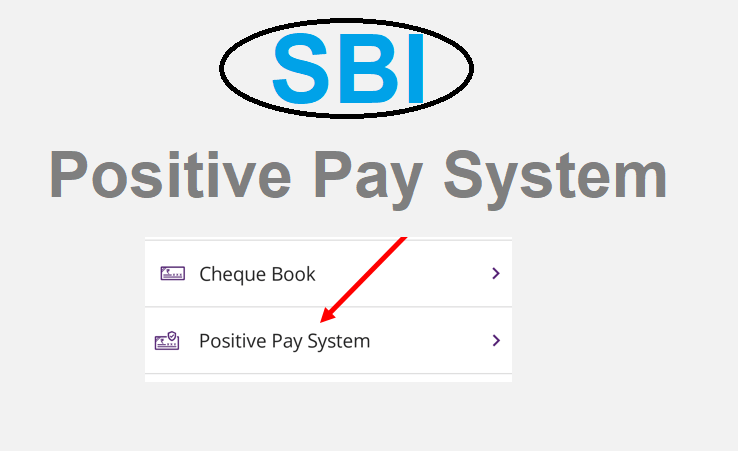

i). Open the Yono Lite application. Select the ‘Requests‘ option.

ii) Select the ‘Positive Pay System’ option on the next screen.

iii). Select the ‘Cheque Lodgement Details‘ for the process to Submit the ‘Positive Pay System‘.

iv). Now, you have to select your account number. Then enter 6 digits cheque number, the issue date of the cheque, and the amount. Click on Submit option. On submission, a ‘Positive Pay System‘ process will be completed.

See also – What is Bulk Posting in SBI

Using Yono SBI

Not only mobile banking, but you can do the same through net banking. Below, we have mentioned a step-by-step guide on how to do it through the mobile app.

1: Open the Yono SBI app, and select the ‘Services Request‘ option.

2: On the next screen, tap on the ‘Cheques” option.

3: The following screen will appear here. Tap on the ‘Positive Pay System‘ option.

4: Here, you will get a total of five options. Tap on ‘Make a Request.

5: Select the account and enter the cheque date, cheque number, check amount, beneficiary name and instrument type. Tap on the ‘Next‘ option. On the next screen, verify and select ‘Confirm‘ to submit.

Through Internet Banking

SBI net banking is one of the best options if you have a username and password. Login with your username and password. Then you will receive an OTP. Enter OTP and login. You need to follow these steps for the SBI Positive Pay system through net banking.

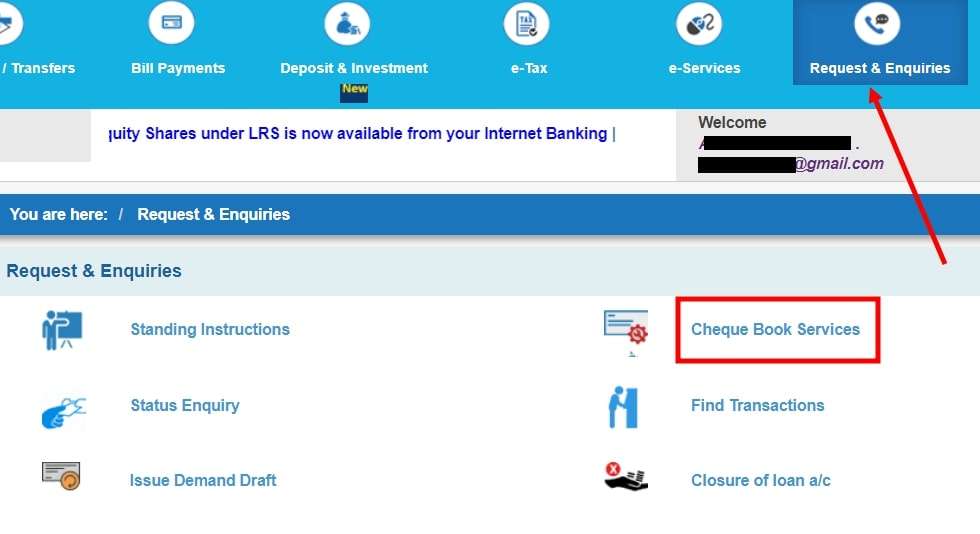

Step 1: Click on the ‘Request and Enquiries‘ option and next click on the ‘Cheque Book Services‘ option.

Step 2: Get the ‘Positive Pay System‘ option on the next page. Select the ‘Positive Pay System‘ option.

Step 3: Here, you need to select your account number. Then, click on the ‘All cheques‘ or ‘Cheques beyond Prescribed limit‘ option. For the second option, ‘Cheques beyond Prescribed limit‘, you have to enter the limit amount. Check the terms box and click on the ‘Submit‘ option.

Step 4: Enter cheque details and payee name. Click on the ‘Confirm‘ option.

So now, when the cheque recipient submits it to SBI for encashment, the cheque details are validated against the information provided by the customer through the positive payment system.

How To Submit SBI Positive Pay System Offline?

You must visit the SBI branch and fill out the form to use the SBI Positive Pay system. You have to enter your account number, recipient name, amount, account details, and date. Then, attach your cheque with the form and submit it to the bank employees.

Things To Know About SBI Positive Pay System:

- You need to complete a one-time registration for SBI Positive Pay System.

- You can do registration through mobile banking, net banking or by visiting the branch.

- SBI Positive Pay System is a concept for high-value cheques to prevent fraud.

- The bank officials will cross-check the cheque information at the time of encashment. They will check the details that you have entered while submitting for Positive Pay System.

- The minimum limit for SBI Positive Pay System is Rs 50000/- and above.

- A positive pay system will be mandatory for SBI savings accounts of 5 lakhs and above and current accounts of 10 lakhs and above.

See also – SBI ATM Pin Generation Online

Benefits

It is beneficial for the customer who submits the form for the process of a positive pay system. So, the SBI Positive Pay System is a measure to prevent fraud through tampering with cheques. This will re-verify the bank employees’ cheque information (you entered) at the time of encashment.

FAQs

A: It is a measure for preventing fraud through tampering/change in check details. Bank will re-verify the cheque details, which will be cross-checked with the cheque presented at the time of encashment.

A: If you are an SBI customer, you can register through mobile banking (Yono Lite/YONO SBI) or Net banking. You have to enter the cheque lodgement details before submitting.

A: The minimum limit for SBI Positive Pay System is Rs 50000/- and above.