Trident is a leading company known as Trident Limited, which is listed on Indian exchanges (NSE and BSE). The company has shown stable financial results in the last two years and the same is expected to continue in the coming years.

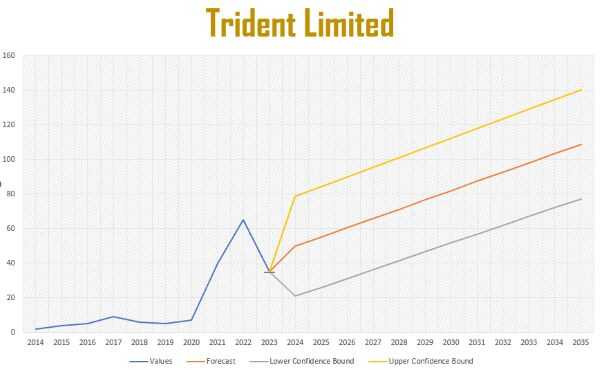

For more details, we are going to predict its share price for the periods of 2024, 2025, 2026, 2028, 2030, and 2035.

According to official data, the company reported revenue of Rs 1,812 crore and net profit of Rs 90.28 crore in the September quarter, up 20% year-on-year.

In recent years, the company has expanded its operations and diversified into new areas such as renewable energy. Market experts say that it will remain bullish and returns of up to 30% can be expected in the next 24 months.

Currently, the company is trading at Rs 42.10 in the market and can reach Rs 45.20 to Rs 52.10 by 2024. If we look at the year 2025, the share price of Trident can reach the level of Rs 55.30 to Rs 68.50.

Trident Ltd – Overview

Trident Limited is a group of companies operating in various sectors like paper, chemicals, energy, etc. It is engaged in the manufacturing of paper products, such as writing paper, printing paper, fine paper, packaging paper, and many more.

Fundamentals of Trident

Trident Limited is a good stock for the long term, it has many promising prospects such as it has very low debt and a high dividend payout ratio. Moreover, it is an organized company and strong management, so they can handle the issues easily.

| Company Name | Trident Limited |

| Industry | Agro-based paper manufacturers |

| Country | India |

| Primary Exchange | NSE/BSE |

| EPS (TTM) | 0.97 |

| PE Ratio | 29.54 |

| Dividend Yield | 1.26 |

| ROE | 23.25% |

| Buy / Sell / Hold | Hold |

| Debt to Equity | 0.31 |

| Face Value | 1 |

Trident Ltd share price history (last 5 years)

Trident stock’s historical share price performance has seen a lot of ups and downs over the past few years:

| Year | Month | Low | High |

|---|---|---|---|

| 2018 | Feb | 7.11 | 7.50 |

| 2018 | Aug | 5.28 | 5.89 |

| 2019 | Feb | 5.90 | 6.74 |

| 2019 | Aug | 5.28 | 5.89 |

| 2020 | Feb | 5.50 | 6.50 |

| 2020 | Aug | 6.45 | 7.10 |

| 2021 | Feb | 13.40 | 15.20 |

| 2021 | Aug | 19.00 | 22.65 |

| 2022 | Feb | 47.65 | 63.85 |

| 2022 | Aug | 35.00 | 41.85 |

Related: Tata Chemicals share price target

Trident share price target 2024-2035

Our research and analysis show that the company’s financial performance, market trends, history, debt percentage, growth, and overall market position are favorable.

However, the target share price of Trident is the estimated value, not the exact price. It has huge growth potential over the next 5 years and we can expect the share price to rise by 87%. So if we invest Rs 100, it can become Rs 187 in the next five years.

Trident share price target for 2024

In 2024, the lowest target price for Trident shares is Rs 42.10 to Rs 52.20. At the end of the year, the highest price for Trident shares can reach Rs 48.30 to Rs 67.10.

| Low | High |

|---|---|

| Rs 42.10 | Rs 52.20 |

| Rs 48.30 | Rs 67.10 |

Trident share price target for 2025

According to our forecast system, Trident’s share price could be Rs 53.22 to Rs 64.30 in 2025. Whereas the maximum share price of Trident can reach the level of Rs 61.10 to Rs 74.40.

| Low | High |

|---|---|

| Rs 53.22 | Rs 64.30 |

| Rs 61.10 | Rs 74.40 |

Trident share price target for 2026

The price target for Trident shares in early 2026 could be Rs 68.40 to Rs 82.20. At the same time, the maximum share price target for Trident can reach Rs 82.10 to Rs 91.10.

| Low | High |

|---|---|

| Rs 68.40 | Rs 82.20 |

| Rs 82.10 | Rs 91.10 |

Trident share price target for 2028

Our analysis shows, that the company will remain bullish in the future and the share price may reach Rs 93.40 to Rs 105.25 in 2028. Whereas the maximum price of Trident shares can reach the level of Rs 105.15 to Rs 135.30 by 2028.

| Low | High |

|---|---|

| Rs 93.40 | Rs 105.15 |

| Rs 105.25 | Rs 135.30 |

Trident share price target for 2030

In 2030, the minimum target price for Trident shares is Rs 140.35 to Rs 162.35 at the beginning of the year. Trident’s maximum share price target could reach Rs 178.14 to Rs 195.45 by the end of 2030.

| Low | High |

|---|---|

| Rs 140.35 | Rs 162.35 |

| Rs 178.14 | Rs 195.45 |

Trident share price target for 2035

According to our research and technical analysis, the minimum and maximum target price for Trident shares by 2035 is Rs 375.20 to Rs 450.50.

| Low | High |

|---|---|

| Rs 375.20 | Rs 450.50 |

Trident Share Price Performance

| Year | Target Price | Change |

|---|---|---|

| 2024 | Rs 46.23 | 21.05% |

| 2025 | Rs 64.32 | 39.13% |

| 2026 | Rs 70.25 | 52.17% |

| 2028 | Rs 96.15 | 108.70% |

| 2030 | Rs 122.35 | 165.22% |

| 2032 | Rs 172.22 | 273.91% |

| 2035 | Rs 250.50 | 443.48% |

Risk Factors

The following factors may affect Trident’s share price:

- Performance of the Company

- Product Demands in the Market

- Financial Performance

- Competition in the Market

- Industry Trends

- Geopolitical Events

Stock prices can be unpredictable and many factors can affect the price. You need to understand the risks and potential returns of any investment.

FAQs

A: Looking at the financial growth and low debt, we can say that this stock is good for the long term.

A: The target price for Trident shares will be Rs 61.10 to 74.40 in 2025.

A: The company has undertaken the following activities to promote its own brand’s growth:

i) Launched its e-commerce websites in India and the US.

ii) Increased presence in new geographies such as the Americas and the Middle East.

iii) Started own warehouse operation to increase market penetration in India.

iv) Use of machine learning and AI analytics to optimize costs and add sustainable profits.

The highest target price for Trident shares in 2028 will be Rs 105.25 to Rs 135.30.

The highest target price for Trident shares is Rs 178.14 to Rs 195.45 by 2030.

Related:

Conclusion

Trident is now bullish for the long term, it has low debt and a price-earnings ratio of 34.26, and overall in our research, we can say that this stock is good for the long term.

Disclaimer: Price forecasts are for general information only and no part of the website content provided by us should be considered as financial advice for your investments. Consult your financial advisor before investing.